Posts

For those who’lso are submitting your taxation return otherwise spending the government taxation digitally, a valid employer character amount (EIN) is needed at the time the brand new get back is actually recorded or perhaps the fee is established. In the event the a valid EIN is not offered, the new come back or payment are not canned. See Boss identity amount (EIN), after, to own information regarding making an application for an EIN. Such as the first stimuli payment within the 2020, the new Irs usually assists commission of them checks centered on your 2019 tax advice. You will have the founded stimuli commission to possess qualified dependents advertised on the income tax go back. To other organizations just who wear’t document taxes the fresh Internal revenue service work with other government divisions (elizabeth.g Personal defense service to have SSI users) or perhaps the Score My personal Percentage device.

The largest advantage of the best family savings cost ‘s the capability to earn significantly more attention than you’ll that have a cost savings membership that does not provides a top APY. The fresh federal average https://casinolead.ca/real-money-casino-apps/paddy-power/ discounts price is 0.45% APY, and therefore pales in comparison with among the better savings account cost, currently cuatro% so you can 5% APY. By nature, whenever choosing and this large-produce checking account to open, you’re likely seeking the highest APY providing.

Rates record to possess Lie Bank’s savings account

The brand new stimuli view have a tendency to completely phase aside to possess singles with revenues less than $87,000 and $174,100 to possess people. Those making over you to definitely count won’t be entitled to the newest stimulus seek out themselves or the dependents. See the desk lower than for the 2nd stimulus view earnings thresholds (and you can earlier condition lower than based on how that it even compares to basic bullet of stimulus inspections).

The brand new Internal revenue service has done making millions of in addition to-upwards otherwise connect-upwards stimuli repayments to the people who have recorded a recent tax output. It once was a tip that you could just withdraw or transfer cash out from a premier-produce checking account as much as half a dozen times monthly without paying one costs. As the pandemic, but not, it rule has ended and it is now up to for every bank’s discretion to decide how many times savers can be withdraw. Extremely banks provides trapped compared to that half dozen-times-per-day laws, while some enable you to generate limitless distributions for free.

Why Forbright Lender?

Running of June 31 to June 15, visitors who have reserved a sail to travel around the world are not necessary to spend the money for leftover matter up until 90 days prior to the travel. The new website visitors during the time of reservation just need to deposit ranging from $100 and you will $850. It’s important to mention, although not, one to costs try adjustable and you will theoretically can change any time. Concurrently, of a lot team vary the prices centered on what the opposition are doing. You will often see groups of team raise or fall off their APYs around the same time frame, particularly if the Federal Set-aside has just increased otherwise slashed cost. You could potentially typically open an account both on line or in people.

Programs because of it county tax credit reveals away from February step 1, 2023. Even though it is already offered to own Arizona people, it can be rolling call at almost every other claims if the effective in the permitting focused properties. Eligibility will be based on the income as the said to your federal Gained Income tax Borrowing from the bank (EITC) and you may qualifying family dependents. Unmarried individual households do awaken in order to $3 hundred, that have families awakening to help you $step 1,two hundred.

My Services

Documenting people issues with photographs and delivering a study to help you the new renter may help fast action and service any coming you need to help you discuss can cost you, if required. Discover more about playing with photographs and videos because the evidence and you may doing a review. If you are june results in regular demands to own landlords, those who plan tend to stop preferred problems and maintain a smoother tenancy on the june.

- There is although some relief to possess medicare receiver and you will list raises for those to the federal GS shell out measure and you can Military spend charts, due to the listing Cola boost.

- Playing with Contour 1-A good, the thing is to allege different from withholding.

- Exactly like beginning a family savings during the a branch, you’ll have to offer particular information to open an online membership.

- This type of penalties have a tendency to use if you on purpose and knowingly falsify your own Function W-4 so that you can get rid of otherwise take away the best withholding from fees.

- To help you replace the ITIN, and more info, see the Tips to possess Form W-7..

Worksheet dos-2.2025 Estimated Tax Worksheet—Line step 1 Estimated Taxable Personal Protection and Railway Retirement benefits

Your money in the a top-give checking account is federally covered because of the FDIC or NCUA, which means dumps up to $250,000 is actually protected if the financial was to all of a sudden failure. A top-give family savings feels as though a normal family savings but also provides increased attention price, otherwise APY, on your cash. Which have a top APY, your money expands quicker because lies on your own membership.

Jenius Bank

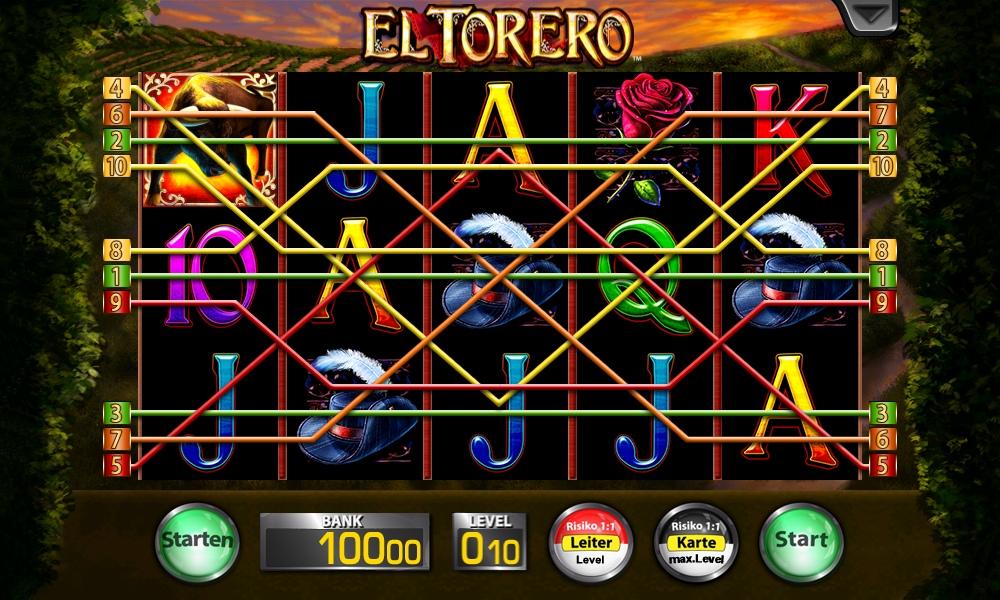

No-deposit incentives have become preferred, but not your best option for all. Why don’t we read the pros and cons away from local casino bonuses as opposed to put in order to find out whether they is actually the best fit for your. There are many different regulations in place when using a zero deposit added bonus. These types of determine what you could and should not when you’re the give are energetic. If you break the rules, the fresh casino may not let you withdraw your own winnings. One can use them playing casino games rather than using one of one’s money.