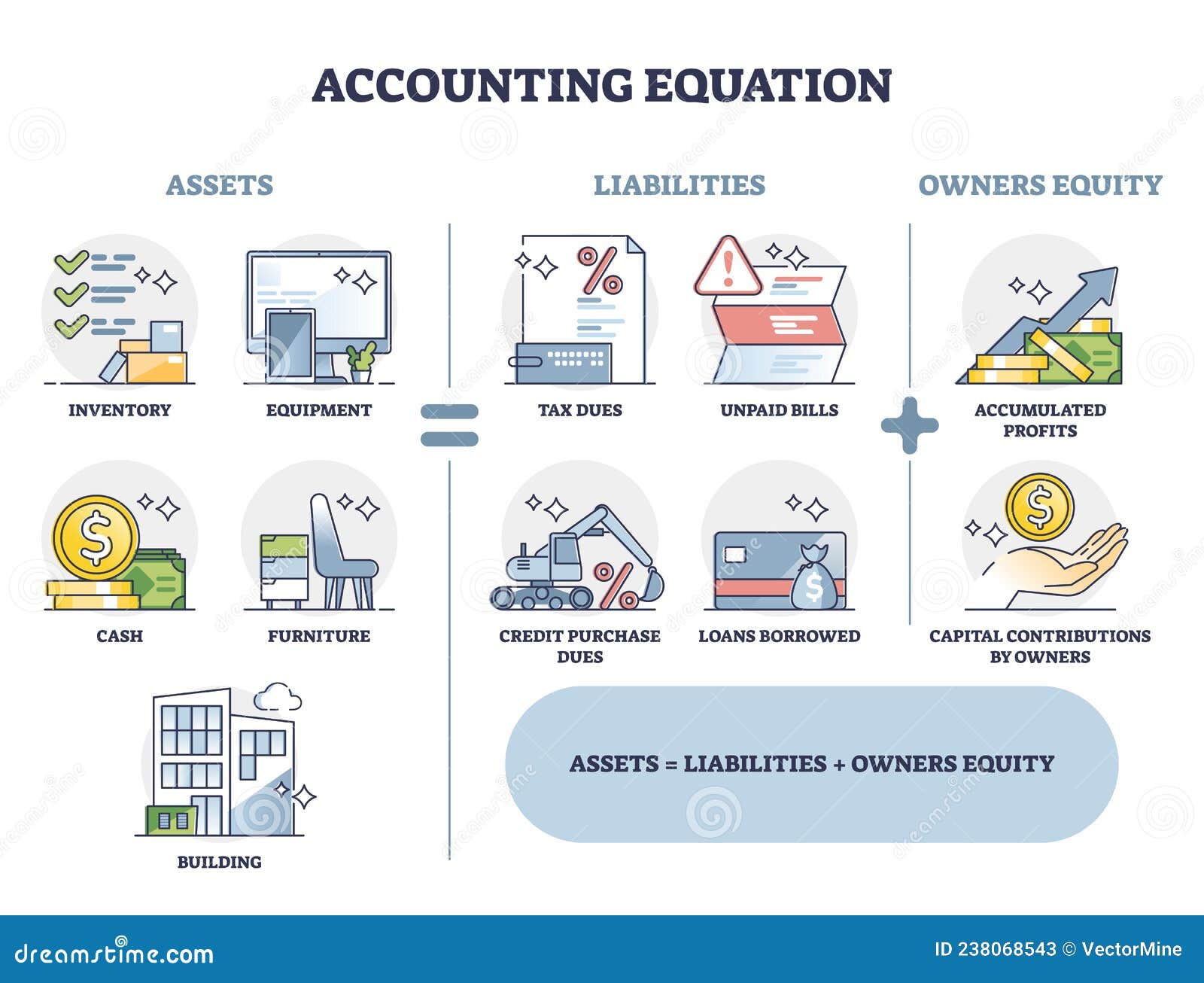

The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received). Since the balance sheet is founded on the principles of the accounting equation, this equation can also be said to be responsible for estimating the net worth of an entire company. The fundamental components of the accounting equation include the calculation of both company holdings and company debts; thus, it allows owners to gauge the total value of a firm’s assets.

How to Read & Understand a Balance Sheet

The $20 worth of coffee has increased our inventory, and we have $5 in cash left over. Even though we have multiple entries with varying amounts, our accounting equation still balances. A company’s balance sheet provides important information on a company’s worth, broken down into assets, liabilities, and equity. Investors can gain valuable insight from this financial statement since it shows a company’s resources and how it is funded to evaluate its financial health. Furthermore, the balance sheet is a key source for analyzing the various performance metrics of a company, such as its return on assets ratio, debt-to-equity (D/E) ratio, and liquidity ratio. Under the accrual basis of accounting, expenses are matched with revenues on the income statement when the expenses expire or title has transferred to the buyer, rather than at the time when expenses are paid.

How is the Balance Sheet used in Financial Modeling?

The income statement and balance sheet typically use the accrual method of accounting, which means transactions are made, but money may not be collected or paid out yet. In double-entry accounting, everything on the left side under “assets” and everything sales price definition on the right side under “liabilities and equity” in the accounting equation must balance. If something decreases on the left side, it must decrease on the right side. If something goes up on the left side, it must go up on the right side.

More Accounting Equation Resources

On 1 January 2016, Sam started a trading business called Sam Enterprises with an initial investment of $100,000. The effects of changes in the items of the equation can be shown by the use of + or – signs placed against the affected items. In the below-given figure, we have shown the calculation of the balance sheet. Debits and Credits are the words used to reflect this double-sided nature of financial transactions. For example, imagine that a business’s Total Assets increased by $500.

- For example, if a company buys a $1,000 piece of equipment on credit, that $1,000 is an increase in liabilities (the company must pay it back) but also an increase in assets.

- All of our content is based on objective analysis, and the opinions are our own.

- These revenues will be balanced on the assets side, appearing as cash, investments, inventory, or other assets.

- So, as long as you account for everything correctly, the accounting equation will always balance no matter how many transactions are involved.

You can think of them as resources that a business controls due to past transactions or events. Liabilities are owed to third parties, whereas Equity is owed to the owners of the business. This transaction affects only the assets of the equation; therefore there is no corresponding effect in liabilities or shareholder’s equity on the right side of the equation. The assets are the operational side of the company, basically a list of what the company owns. Everything listed there is an item that the company has control over and can use to run the business.

The claims to the assets owned by a business entity are primarily divided into two types – the claims of creditors and the claims of owner of the business. In accounting, the claims of creditors are referred to as liabilities and the claims of owner are referred to as owner’s equity. In the asset sections mentioned above, the accounts are listed in the descending order of their liquidity (how quickly and easily they can be converted to cash). Similarly, liabilities are listed in the order of their priority for payment. In financial reporting, the terms “current” and “non-current” are synonymous with the terms “short-term” and “long-term,” respectively, and are used interchangeably. Generally, sales growth, whether rapid or slow, dictates a larger asset base—higher levels of inventory, receivables, and fixed assets (plant, property, and equipment, or PPE).

First, the fixed asset turnover ratio (FAT) shows how much revenue a company’s total assets generate. Second, the return on assets (ROA) ratio shows how much profit is being generated from its total assets. Lastly, the cash conversion cycle (CCC) shows how well a company is managing its accounts receivables and inventory. Importantly, the cash conversion cycle is an important indicator of a company’s working capital, which is the difference between its current assets and current liabilities. How assets are supported, or financed, by a corresponding growth in payables, debt liabilities, and equity reveals a lot about a company’s financial health.

In order to help you advance your career, CFI has compiled many resources to assist you along the path. Includes non-AP obligations that are due within one year’s time or within one operating cycle for the company (whichever is longest). Notes payable may also have a long-term version, which includes notes with a maturity of more than one year. $30,000 is credited to cash, and $30,000 is debited to inventory. External auditors, on the other hand, might use a balance sheet to ensure a company is complying with any reporting laws it’s subject to.