Mastering the Exness Scalping Strategy: A Comprehensive Guide

The Exness Scalping Strategy https://exnesscom.net/ is a popular method among traders looking to capitalize on small price movements in the forex market. This strategy involves making numerous trades throughout the day, each aiming for a small profit. In this article, we will delve into the details of the Exness Scalping Strategy, discuss its advantages and drawbacks, and provide tips on how to implement it effectively.

What is Scalping?

Scalping is a trading style that focuses on making quick profits by entering and exiting trades in a short time frame. Scalpers typically hold positions for a few seconds to several minutes, making numerous trades per day. The goal is to exploit tiny price movements, which can add up to significant gains over time. This strategy requires a strong understanding of the market, quick decision-making skills, and a disciplined approach.

Why Choose the Exness Scalping Strategy?

The Exness Scalping Strategy is tailored for traders who prefer quick trades and immediate results. Here are some reasons why this strategy has gained popularity:

- High Frequency of Trades: Scalping allows traders to take advantage of numerous opportunities throughout the trading day.

- Flexibility: Traders can easily adjust their approach based on market conditions.

- Potential for Quick Profits: Because scalpers focus on minor price changes, even small market movements can result in profit.

- Reduced Market Risk: Positions are held for a shorter duration, minimizing exposure to larger market shifts.

How to Implement the Exness Scalping Strategy

Implementing the Exness Scalping Strategy requires a well-defined approach. Here are some steps to guide you through the process:

1. Choose the Right Trading Platform

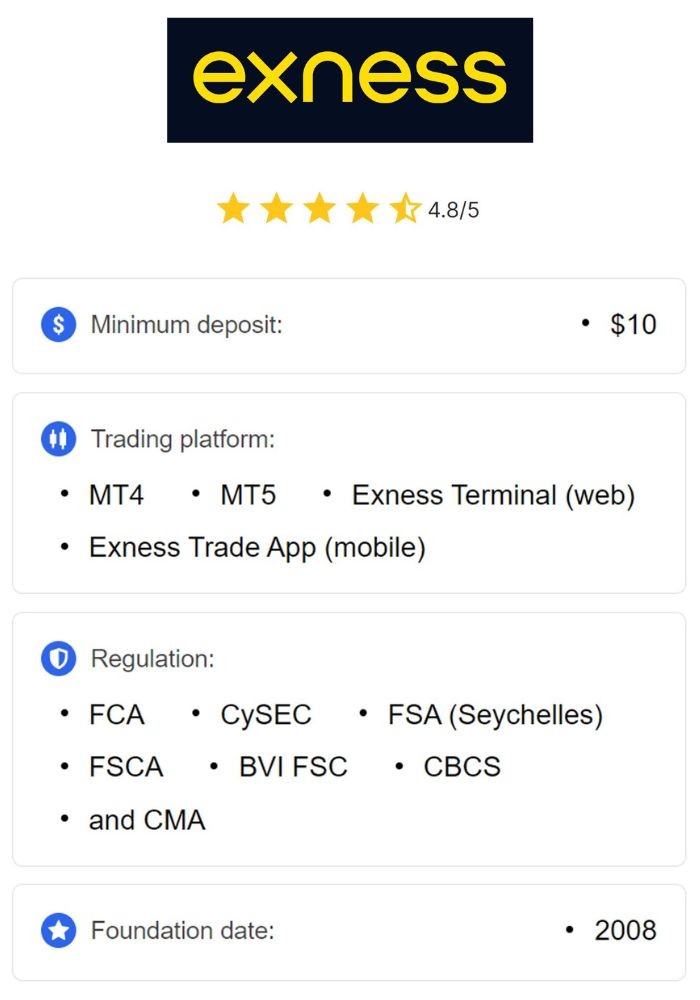

To effectively implement your scalping strategy, it is crucial to choose the right broker. Exness, known for its low spreads and fast execution speeds, is a good choice. Make sure the trading platform you select provides reliable tools and resources for scalpers.

2. Select Your Trading Instruments

While scalping can be applied to various instruments, it is best to stick to highly liquid markets. Major currency pairs like EUR/USD, USD/JPY, and GBP/USD are excellent for scalping due to their tight spreads and high trading volumes.

3. Determine Entry and Exit Points

Establish clear criteria for entering and exiting trades. Use technical analysis indicators such as moving averages, Bollinger Bands, and the Relative Strength Index (RSI) to identify potential entry and exit points. Scalpers often look for small price discrepancies to enter trades.

4. Manage Your Risk

Effective risk management is vital in scalping. Determine your risk tolerance and set a stop-loss order for every trade. Many scalpers risk no more than 1% of their trading capital on a single trade to preserve their account balance.

5. Practice Consistency

Consistency is key in scalping. Stick to your strategy, maintain discipline, and resist the urge to deviate from your plan based on emotions. Keep track of your trades and analyze your performance to identify areas for improvement.

Tools and Indicators for Scalping

Several tools and indicators can support your scalping efforts. Here are a few essentials:

- Charting Software: Advanced charting software can provide real-time data and analysis tools that are invaluable for scalpers.

- Technical Indicators: Utilizing indicators such as the MACD, RSI, and Moving Averages can help you identify trends and potential reversals.

- Economic Calendar: Staying updated on economic events and news releases can help you make informed trading decisions, as these events can impact market volatility.

Advantages of the Exness Scalping Strategy

The Exness Scalping Strategy offers numerous advantages, making it attractive to many traders:

- Opportunity for Frequent Profit: The potential for securing quick profits through numerous trades increases the chance of making money.

- Market Engagement: Scalping keeps traders actively engaged with the market, encouraging continuous learning and skill development.

- Flexibility in Trading Style: Traders can scalp at any time of day or night, allowing for personalized trading schedules.

Challenges of the Exness Scalping Strategy

While there are several advantages to scalping, there are also challenges to be aware of:

- High Stress Levels: The fast-paced nature of scalping can be stressful, requiring quick judgment and decision-making skills.

- Transaction Costs: Frequent trading can result in higher transaction costs, which may eat into profits.

- Market Noise: In the quest for small price movements, traders may find themselves grappling with market noise, causing false signals.

Conclusion

The Exness Scalping Strategy can be an effective approach for traders seeking quick profits through short-term trades. However, it requires a solid understanding of the market, effective risk management, and a disciplined mindset. By following the guidelines outlined in this article, you can enhance your scalping skills and maximize your trading potential. Remember to continuously evaluate your performance, adjust your strategy as needed, and stay informed about market trends and news to become a successful scalper in this dynamic trading landscape.